August 6, 2024

Farmer sentiment improves regardless of monetary efficiency considerations

|

|

Farmer sentiment improves regardless of monetary efficiency considerations. (Purdue/CME Group Ag Economic system Barometer/James Mintert) |

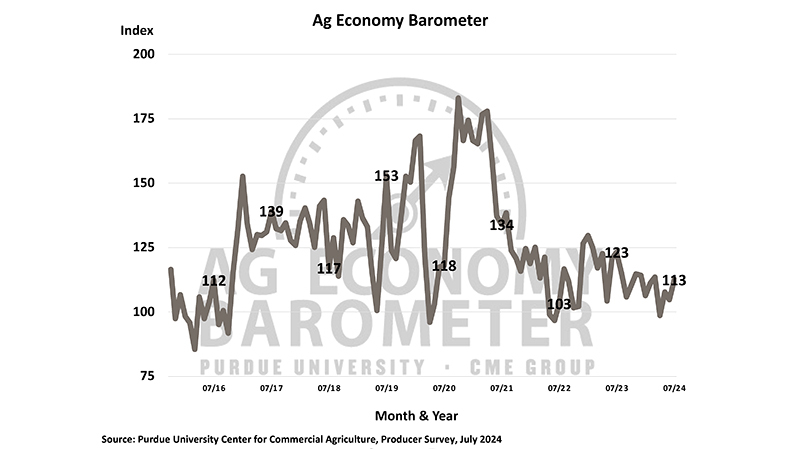

WEST LAFAYETTE, Ind. — Three broad-based measures of farmer sentiment improved in July because the Purdue University/CME Group Ag Economy Barometer index rose 8 factors to 113, the Index of Present Situations elevated by 10 factors to 100, and the Index of Future Expectations at 119 was 7 factors increased than a month earlier. Regardless of declines in corn and soybean costs from mid-June to mid-July — Jap Corn Belt money costs fell 11% and 5%, respectively — farmer sentiment improved in July. Responses to the person questions attribute this constructive shift to fewer respondents reporting worsened circumstances in comparison with a 12 months in the past and a lower in these anticipating unfavorable future outcomes. This month’s Ag Economic system Barometer survey was carried out from July 15-19, 2024.

The July survey confirmed that top enter prices remained the most important concern for 34% of farmers. Moreover, the chance of decrease crop and livestock costs continues to fret producers, with 29% citing it as a prime concern, up from 25% in June. Reflecting the indicators from the Federal Reserve that rates of interest have peaked, solely 17% of respondents cited rising rates of interest as a prime concern, down from 23% final month.

The Farm Monetary Efficiency Index dropped 4 factors in July to 81, 6 factors decrease than in July 2023. The decline in monetary efficiency expectations mirrored farmers’ worries about weakening commodity costs and excessive enter prices following enhancements within the Could and June indices. Though manufacturing prices for principal crops, together with corn and soybeans, have decreased 12 months over 12 months, output costs have additionally fallen, elevating the opportunity of a cost-price squeeze for U.S. crop producers.

Regardless of considerations about farms’ monetary efficiency, the Farm Capital Funding Index rose 6 factors in July to 38, although it stays weak, at 7 factors decrease than in July 2023. This enchancment was on account of a slight lower within the variety of producers who imagine it’s a foul time to make massive investments, which dropped from 80% in June to 75% in July.

“Declines in crop costs level to decrease producer incomes this 12 months, so the rise in optimism was considerably puzzling,” mentioned James Mintert, the barometer’s principal investigator and director of Purdue College’s Center for Commercial Agriculture. “Fewer producers citing rising rates of interest as a main concern for the upcoming 12 months corresponds with the modest enchancment of their views on capital investments, however respondents proceed to precise hesitancy to make massive investments.”

July noticed a small enchancment within the Quick-Time period Farmland Worth Expectations Index, rising to 118 from 115 in June. This was pushed by extra respondents anticipating steady farmland values over the subsequent 12 months. On the similar time, the Lengthy-Time period Farmland Worth Expectations Index dropped 6 factors from June to 146, with fewer farmers anticipating values to rise over the subsequent 5 years and extra anticipating they’ll stay unchanged.

As nationwide discussions start for the 2025 crop 12 months’s farmland leases, the July survey revealed that almost three-fourths (72%) of crop farmer respondents anticipate money rental charges to stay roughly the identical as in 2024. Among the many remaining respondents, views have been practically evenly divided, with 15% anticipating an increase in charges and 13% anticipating a decline.

In regards to the Purdue College Heart for Business Agriculture

The Center for Commercial Agriculture was based in 2011 to supply skilled improvement and academic applications for farmers. Housed inside Purdue College’s Division of Agricultural Economics, the middle’s college and workers develop and execute analysis and academic applications that tackle the totally different wants of managing in right this moment’s enterprise surroundings.

About CME Group

Because the world’s main derivatives market, CME Group allows purchasers to commerce futures, choices, money and OTC markets, optimize portfolios, and analyze knowledge — empowering market members worldwide to effectively handle threat and seize alternatives. CME Group exchanges supply the widest vary of world benchmark merchandise throughout all main asset courses primarily based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The corporate gives futures and choices on futures buying and selling by way of the CME Globex® platform, mounted revenue buying and selling by way of BrokerTec and overseas alternate buying and selling on the EBS platform. As well as, it operates one of many world’s main central counterparty clearing suppliers, CME Clearing.

CME Group, the Globe emblem, CME, Chicago Mercantile Change, Globex, and E-mini are logos of Chicago Mercantile Change Inc. CBOT and Chicago Board of Commerce are logos of Board of Commerce of the Metropolis of Chicago, Inc. NYMEX, New York Mercantile Change and ClearPort are logos of New York Mercantile Change, Inc. COMEX is a trademark of Commodity Change, Inc. BrokerTec and EBS are logos of BrokerTec Europe LTD and EBS Group LTD, respectively. The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“S&P DJI”). “S&P®”, “S&P 500®”, “SPY®”, “SPX®”, US 500 and The five hundred are logos of Customary & Poor’s Monetary Companies LLC; Dow Jones®, DJIA® and Dow Jones Industrial Common are service and/or logos of Dow Jones Trademark Holdings LLC. These logos have been licensed to be used by Chicago Mercantile Change Inc. Futures contracts primarily based on the S&P 500 Index are usually not sponsored, endorsed, marketed or promoted by S&P DJI, and S&P DJI makes no illustration concerning the advisability of investing in such merchandise. All different logos are the property of their respective homeowners.

About Purdue College

Purdue College is a public analysis establishment demonstrating excellence at scale. Ranked amongst prime 10 public universities and with two faculties within the prime 4 in america, Purdue discovers and disseminates data with a top quality and at a scale second to none. Greater than 105,000 college students research at Purdue throughout modalities and places, together with practically 50,000 in individual on the West Lafayette campus. Dedicated to affordability and accessibility, Purdue’s fundamental campus has frozen tuition 13 years in a row. See how Purdue by no means stops within the persistent pursuit of the subsequent big leap — together with its first complete city campus in Indianapolis, the Mitch Daniels College of Enterprise, Purdue Computes and the One Well being initiative — at https://www.purdue.edu/president/strategic-initiatives.

Author: Morgan French, mmfrench@purdue.edu

Supply: James Mintert, 765-494-7004, jmintert@purdue.edu

Media Contacts:

Aissa Good, Purdue College, 765-496-3884, aissa@purdue.edu

Dana Schmidt, CME Group, 312-872-5443, dana.schmidt@cmegroup.com

Agricultural Communications: (765) 494-8415;

Maureen Manier, Department Head, mmanier@purdue.edu

Trending Merchandise