March 5, 2024

Modest enchancment in farmer sentiment, but monetary considerations loom

|

|

Modest enchancment in farmer sentiment, but monetary considerations loom. (Purdue/CME Group Ag Economic system Barometer/James Mintert) |

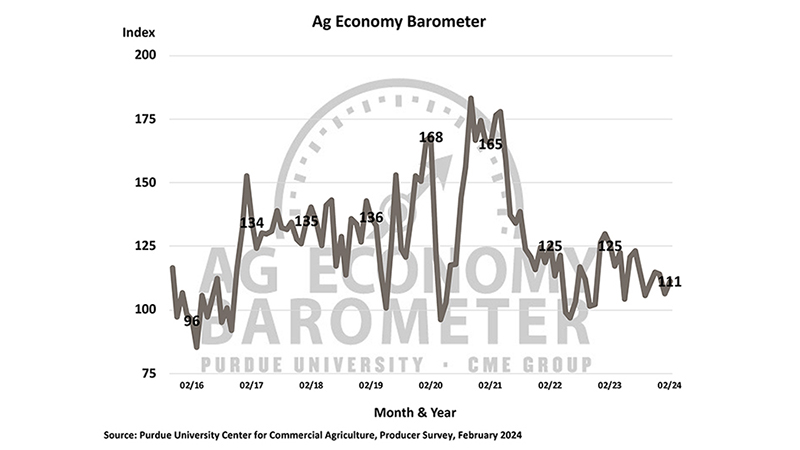

WEST LAFAYETTE, Ind. — The most recent Purdue University/CME Group Ag Economy Barometer reveals a modest improve in farmer sentiment in comparison with the earlier month, although considerations stay concerning farm monetary efficiency within the yr forward.

The February barometer studying reached 111, marking a 5-point rise from final month. The small uptick is attributed to producers expressing elevated optimism concerning the future, with the Future Expectations Index climbing 7 factors to 115. Nonetheless, the Present Circumstances Index remained unchanged. Regardless of their improved outlook for the long run, farmers’ monetary efficiency expectations didn’t preserve tempo. February’s Farm Monetary Efficiency Index registered at 85, a slight dip from January and notably decrease than its current peak in December. The February survey was carried out from Feb. 12-16.

“Weak crop costs proceed to weigh closely on monetary expectations, with mid-February Jap Corn Belt money costs for corn and soybeans declining by 7% and eight%, respectively, in comparison with two months earlier,” mentioned James Mintert, the barometer’s principal investigator and director of Purdue College’s Center for Commercial Agriculture.

When producers have been requested about their main considerations for farm operations within the upcoming yr, the highest concern cited by 34% of respondents was “excessive enter prices,” intently adopted by “decrease crop/livestock costs,” chosen by 28% of respondents. Worries about rising rates of interest amongst producers appear to have diminished considerably, with solely 18% of February respondents citing it as a high concern, down from 26% who did so in November.

The Farm Capital Funding Index stays weak at 34 factors, 9 factors decrease than final yr. Producers expressing reluctance towards making giant investments highlighted considerations over excessive manufacturing prices and weak output costs. The proportion of farmers fearful about farm profitability has tripled since final October. This month, 22 out of each 100 farmers pointed to farm profitability considerations, whereas final fall solely 7 out of each 100 farmers felt the identical means.

The Quick-Time period Farmland Values Expectations Index held regular compared to January however declined by 4 factors from a yr in the past and by 30 factors from two years in the past. Though the farmland index stays constructive, it’s clear that general sentiment concerning future will increase in farmland values is weaker than it was a few years in the past. Amongst producers who count on values to extend within the subsequent yr, the highest purpose cited for his or her optimism was demand from non-farm traders.

Every February, the barometer survey asks producers about progress plans for his or her farm operation within the upcoming 5 years. This yr, 4 out of 10 respondents expressed no plans for progress, with 14% saying they plan to exit or retire. Alternatively, simply over 3 out of 10 respondents anticipate their farm’s annual progress charge to exceed 5%. Responses to this query, which have been constant lately, level to additional consolidation amongst farm operations.

“To place progress charges into perspective, think about {that a} farm operation rising at a 5% annual charge will double in dimension in about 14 years, whereas a farm rising at an annual charge of 10% will want simply seven years to double,” Mintert mentioned.

Curiosity in leasing farmland for photo voltaic power improvement stays robust, with 10% of respondents having mentioned such initiatives within the final six months. Charges diverse extensively, however over half of the respondents reported being supplied lease charges of $1,000 per acre or extra. The highest finish for photo voltaic lease charges seems to be rising over time. When this query was posed in June 2021, simply 27% of respondents reported a lease charge supply of $1,000 or extra per acre, in comparison with 56% of respondents this yr.

Concerning the Purdue College Heart for Business Agriculture

The Center for Commercial Agriculture was based in 2011 to offer skilled improvement and academic packages for farmers. Housed inside Purdue College’s Division of Agricultural Economics, the middle’s college and employees develop and execute analysis and academic packages that deal with the totally different wants of managing in at this time’s enterprise setting.

About Purdue College

Purdue College is a public analysis establishment demonstrating excellence at scale. Ranked amongst high 10 public universities and with two schools within the high 4 in america, Purdue discovers and disseminates information with a high quality and at a scale second to none. Greater than 105,000 college students research at Purdue throughout modalities and areas, together with almost 50,000 in particular person on the West Lafayette campus. Dedicated to affordability and accessibility, Purdue’s major campus has frozen tuition 13 years in a row. See how Purdue by no means stops within the persistent pursuit of the subsequent big leap — together with its first complete city campus in Indianapolis, the brand new Mitchell E. Daniels, Jr. College of Enterprise, and Purdue Computes — at https://www.purdue.edu/president/strategic-initiatives.

About CME Group

Because the world’s main derivatives market, CME Group (www.cmegroup.com) permits shoppers to commerce futures, choices, money and OTC markets, optimize portfolios, and analyze knowledge – empowering market individuals worldwide to effectively handle danger and seize alternatives. CME Group exchanges supply the widest vary of worldwide benchmark merchandise throughout all main asset courses primarily based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The corporate affords futures and choices on futures buying and selling by the CME Globex® platform, mounted earnings buying and selling by way of BrokerTec and overseas alternate buying and selling on the EBS platform. As well as, it operates one of many world’s main central counterparty clearing suppliers, CME Clearing.

CME Group, the Globe brand, CME, Chicago Mercantile Change, Globex, and E-mini are emblems of Chicago Mercantile Change Inc. CBOT and Chicago Board of Commerce are emblems of Board of Commerce of the Metropolis of Chicago, Inc. NYMEX, New York Mercantile Change and ClearPort are emblems of New York Mercantile Change, Inc. COMEX is a trademark of Commodity Change, Inc. BrokerTec and EBS are emblems of BrokerTec Europe LTD and EBS Group LTD, respectively. The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“S&P DJI”). “S&P®”, “S&P 500®”, “SPY®”, “SPX®”, US 500 and The five hundred are emblems of Customary & Poor’s Monetary Providers LLC; Dow Jones®, DJIA® and Dow Jones Industrial Common are service and/or emblems of Dow Jones Trademark Holdings LLC. These emblems have been licensed to be used by Chicago Mercantile Change Inc. Futures contracts primarily based on the S&P 500 Index should not sponsored, endorsed, marketed or promoted by S&P DJI, and S&P DJI makes no illustration concerning the advisability of investing in such merchandise. All different emblems are the property of their respective house owners.

Author: Erin Robinson, erobin@purdue.edu

Supply: James Mintert, 765-494-7004, jmintert@purdue.edu

Media Contacts:

Aissa Good, Purdue College, 765-496-3884, aissa@purdue.edu

Dana Schmidt, CME Group, 312-872-5443, dana.schmidt@cmegroup.com

Associated web sites:

Purdue College Heart for Business Agriculture: http://purdue.edu/commercialag

CME Group: http://www.cmegroup.com/

Agricultural Communications: (765) 494-8415;

Maureen Manier, Division Head, mmanier@purdue.edu

Trending Merchandise